straight life policy develops cash value

Term life policy While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. We show you how to get the most out of your life settlement.

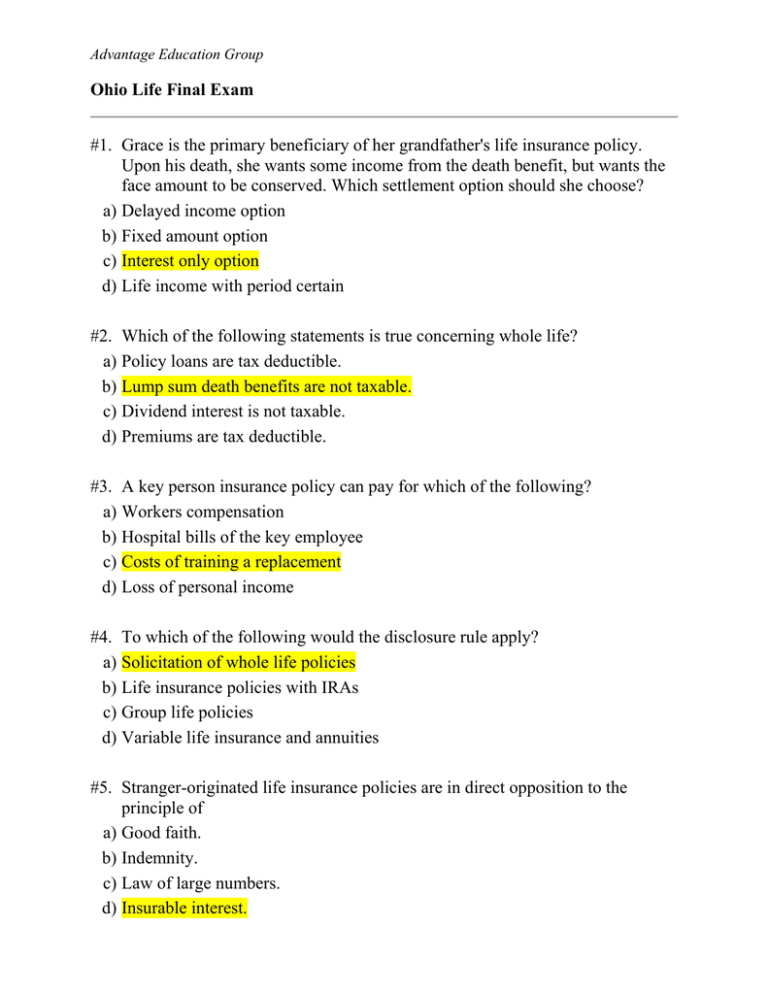

Life Insurance Flashcards Quizlet

Get an instant estimate.

. All policy types qualify. Ten years later your policys cash value. Ad Sell your life insurance policy for cash.

Ad Find out what your policy is worth. The premium steadily decreases over time in response to its growing cash value Affordable. Ad Find out what your policy is worth.

Maximize your cash settlement. Permanent policies designed to develop cash value probably have no value if they are newer. Get an instant estimate.

Find out if you qualify in under 10 minutes. Ad 24 Hour Estimate. 5-Year Term 6580 per year 10-Year Term 7030 per year Straight Life.

Get the info you need. Over 2 Billion Purchased. A straight life insurance policy can also build cash value over time.

It usually develops cash value by the end of the third policy yearC. February 27 2022. Maximize your cash settlement.

Straight life policy develops cash value. Dont sell lapse or cancel until you speak with us. The rate of return will typically be large enough that.

Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. It usually develops cash value by the end of the third policy year. Straight refers to the.

It has the lowest annual premium of the three types of whole life products. What are some true statements. Also known as whole life insurance a.

The face value of the policy is paid to the insured at age 100. Try Our Instant Policy Calculator Today. You were to surrender the policy and take its cash value.

It usually develops cash value by the end of the third policy year. It usually develops cash value by the end of the third policy year. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

Term policies have no cash value. Updated Oct 15 2021. Important information - the value of investments can go down as well as up so you may get.

Which statement is not true regarding a straight life policy. We show you how to get the most out of your life settlement. It usually develops cash value by the end of the third policy year B straight life policies charge a level annual premium through the insureds lifetime and provide a.

The term straight refers to the whole life insurance policys premium structure. Also known as whole or ordinary life. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest.

The face value of the policy is paid to the insured at age 100. It has the lowest annual premium of the three types of. Ad Sell your life insurance policy for cash.

Dont sell lapse or cancel until you speak with us. It has the lowest annual premium of the three types of Whole. A straight life policy has a level premiumit wont change over the life of your policy.

Straight life insurance is. Straight life policy has what type of premium. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

It has the lowest annual premium of the three types of. Try Our Instant Policy Calculator Today. Its premium steadily decreases over time in.

Ad 24 Hour Estimate. The face value of the policy is paid to the insured at age 100B. Which statement is NOT true regarding a straight life policy.

Paperian Cas Wednesday March 2 2022 Edit. Get the info you need. Ad Have over 100K in life insurance.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Over 2 Billion Purchased. Yes if you have a policy with cash value.

As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan. Find out if you qualify in under 10 minutes. Which statement is NOT true regarding a Straight Life policy.

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Life Insurance Flashcards Quizlet

Life Insurance Flashcards Quizlet

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Straddle_Strategy_For_Market_Profits_Jun_2020-02-4f0d46de5d5e4635a47a80a752626d6e.jpg)

Understanding A Straddle Strategy For Market Profits

Life Insurance Flashcards Quizlet

Servant Leadership Develops The Building Blocks For Successful Busin

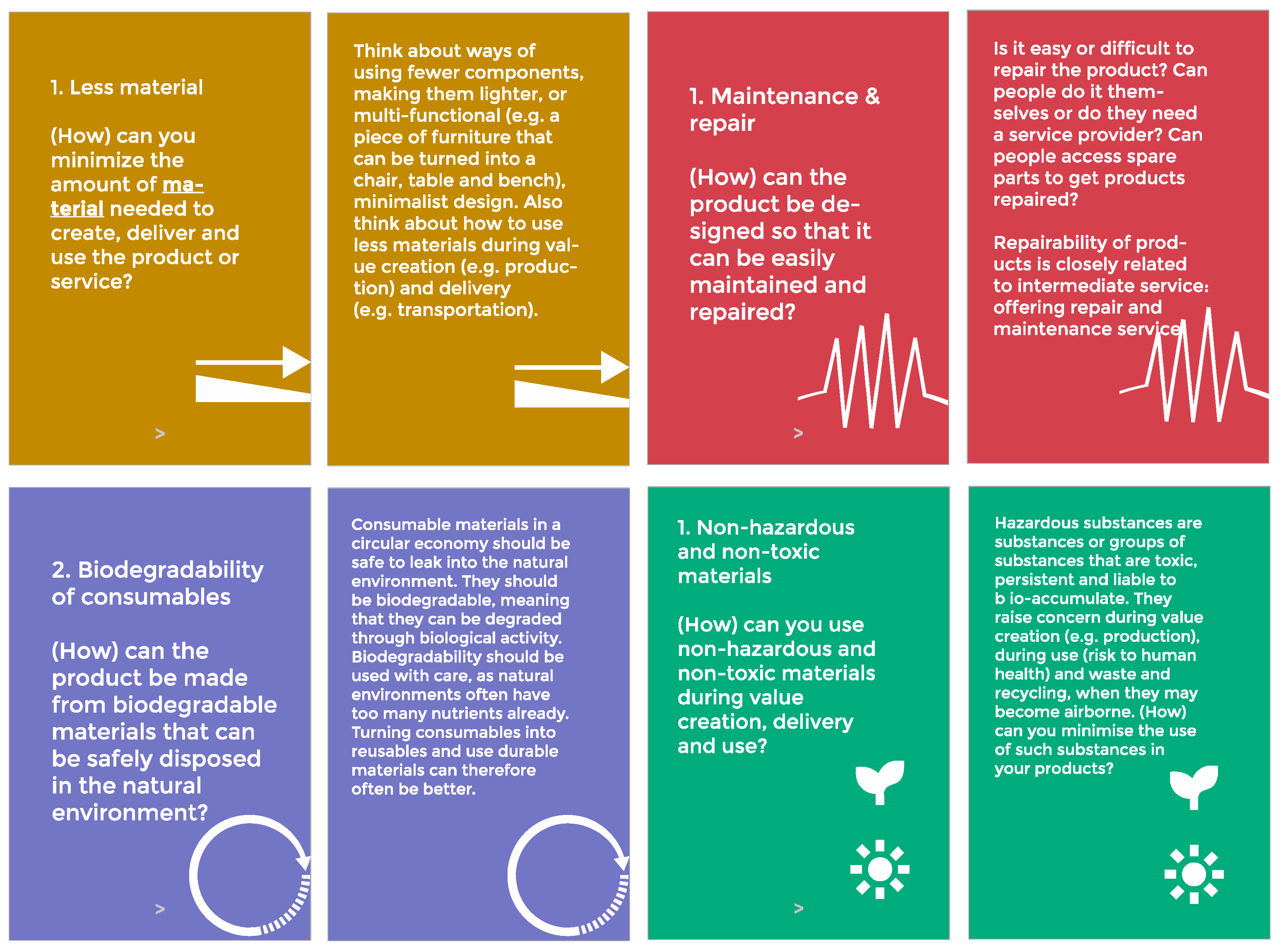

Sustainability Free Full Text A Tool To Analyze Ideate And Develop Circular Innovation Ecosystems Html

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

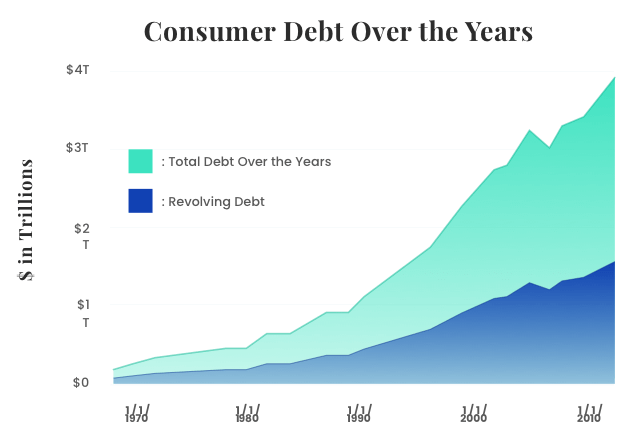

Financial Literacy Guide To Personal Finances

Chapter 7 Premium Foundations Loss Data Analytics

Converting A Term Life Insurance Policy To Whole Life Insurance Bankrate Com

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor